- Family-owned flexible office owner and operator focused on Central London.

- Operates five offices in London Zone 1 and two further city buildings in Cardiff and Edinburgh.

- Joint Venture investor and operator at one additional location in Blackfriars – Tudor Street.

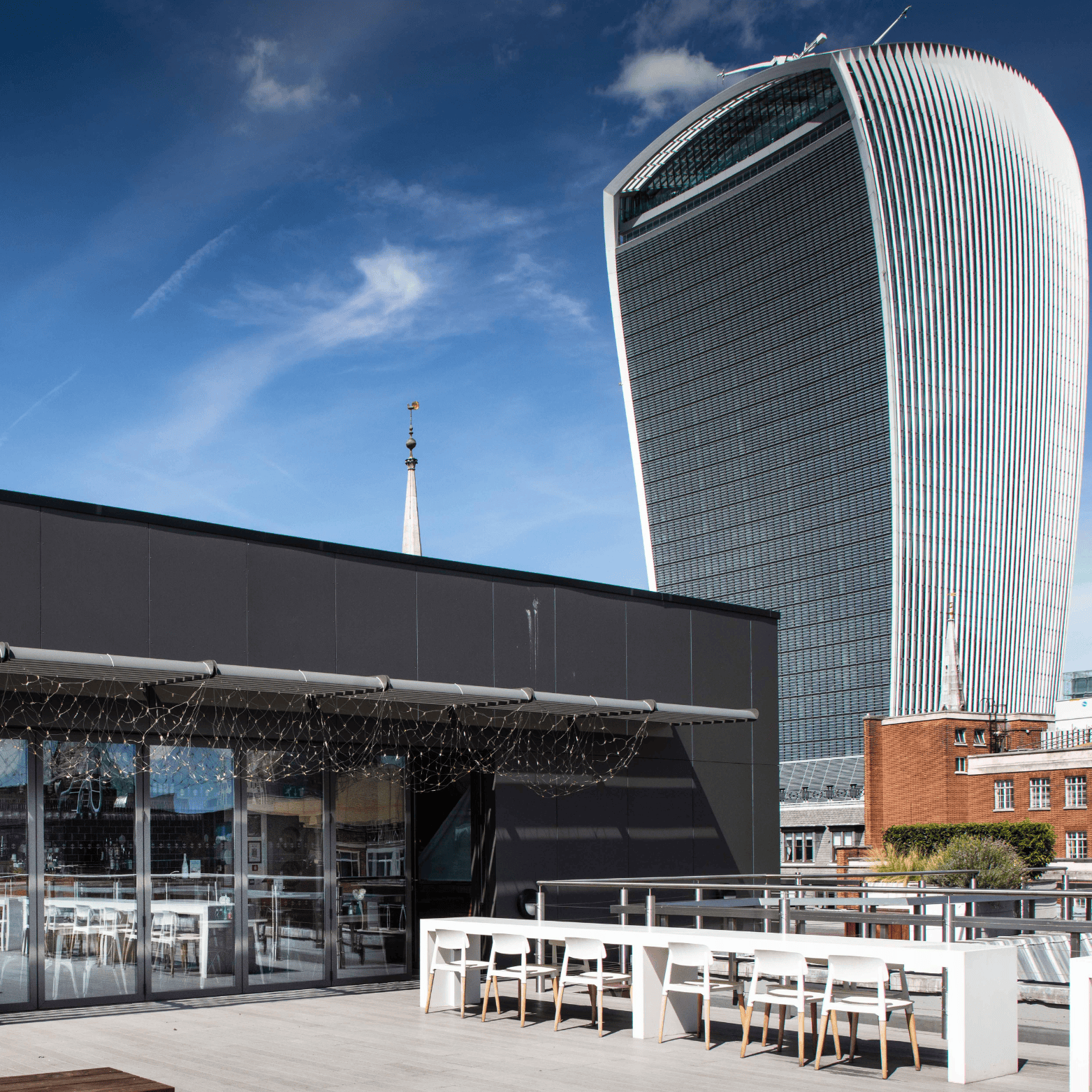

- Proven track record of re-developing sub-prime assets in prime locations to prime standards with strong sustainability credentials (EPC B or above and Planet Mark Certified).

- The Group has a highly diversified tenant-base.

- Highly incentivised site managers aligned to shareholder priorities.

Investment Opportunities OSiT are a highly experienced developer, owner and operator of flexible offices in central London focused on high quality, differentiated assets.

Why Choose Us?

OSiT are a highly experienced developer, owner and operator of flexible offices in central London focused on high quality, differentiated assets.

Unique operating platform and brand

Creators of memorable and practical workspace environments to help tenants thrive.

Strong underlying market demand

Growing demand for Flex office space, with Central London take up in 2024 higher than 2023. 42% of occupiers anticipate 11-50% of their portfolio will include flexible workspace in the next two years.

Proven track record of financial delivery and returns

Profitable, cash generative asset profile with limited maintenance capex and consistent rental growth, with 10%+ yield on cost on developments.

Diverse tenant base

Targeting well-established SME’s and corporates.

Longstanding ESG focus as an ongoing driver of tenant acquisition, retention and rental growth

Highly Sustainable buildings all rated EPC B and BREEAM In-Use and Planet Mark certified / “best newcomer” for 2023. Part of Sunday Times Best Places to Work 2023 and received Customer Ser vice Excellence Accreditation 2024.

Experienced management team

More than 50 years combined experience, currently operating five central London assets with significant development experience.

Opportunistic timing

Development opportunities are available in London due to the ongoing undervaluation.

Strong development expertise

Expected to deliver 18%+ pre-tax equity IRR and >2x+ MoM for LP on most recent development project.

Business Overview

Office Space in Town

Current Stakeholders

Business Overview

Unique developer and operator of prime flexible office buildings in London Zone 1, offering best-in-class EPC B space and amenities to scale alongside occupier base.

Key Portfolio Metrics

Square Feet

Investment Property Value

2023e EBITDA

Target EBITDA CAGR

Target Agreement Fee Growth

avg. YoC on Developments

WAULT

Occupancy

Our Key Leadership

Giles Fuchs

Co-Founder & Chairman

Connect

07730 896830

Niki Fuchs

Co-Founder & CEO

Connect

07710 039249

Sarah Singlehurst

Sales & Marketing Director

Connect

07515 288665

Georgia Sandom

Managing Director

Connect

07557 309155

Sue Kennedy

Finance Director

Connect

Tracey Holloway

Director of OSiT, Wales

Connect

07920 533949

Current Portfolio Overview

Attractive portfolio of Central London assets with a stable, high quality tenant base.

St Pauls 20 Little Britain, London, EC1A 7DH

36,908 sq ft (NIA) • 328 workstations • 6 meeting rooms

Liverpool Street 46 New Broad Street, London, EC2M 1JH

36,038 sq ft (NIA) • 415 workstations • 8 meeting rooms

Monument 20 St. Dunstan’s Hill, London, EC3R 8HL

58,438 sq ft (NIA) • 693 workstations • 15 meeting rooms

Blackfriars 22 Tudor Street, London, EC4Y 0AY

37,916 sq ft (NIA) • 475 workstations • 10 meeting rooms

Waterloo 2-6 Boundary Row, London, SE1 8HP

35,796 sq ft (NIA) • 453 workstations • 9 meeting rooms

Cardiff Temple Court, 13a Cathedral Road, Cardiff, CF11 9HA

18,000 sq ft (NIA) • 253 workstations • 1 meeting rooms

Edinburgh 7/9 North St David Street, EH2 1AW & 14-18 Hill Street, EH2 3JZ

14672 sq ft (NIA) • 240 workstations • 4 meeting rooms

Potential Locations London Areas

Marylebone • Holborn • North Kensington • Bank • Aldgate

Transaction Structure and use of Proceeds

Capital raise to fund an attractive development pipeline at an attractive yield on cost.

Expand our portfolio to a total value of £1 billion, increasing its worth and reach in the market.

£40 -200m per asset, strategically positioned within a 5-minute walk from a Zone 1 station.

10%+ YoC YoC1 transforming sub sub-prime assets into grade A flexible office space.

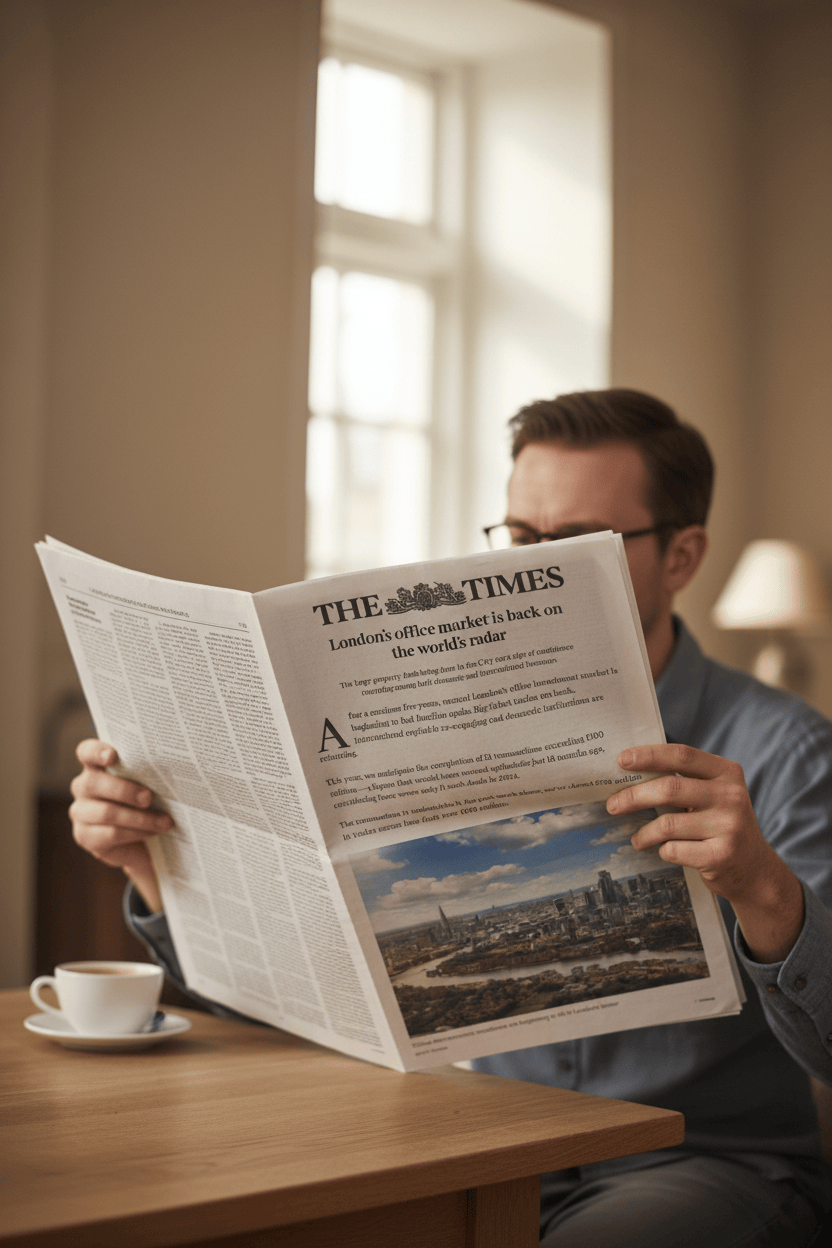

In the Press

Latest Press Releases

OSiT is frequently featured in national and industry publications, podcasts and conferences. As a pioneer in the serviced office sector with decades of experience and deep industry knowledge, our Directors are often invited to share their insights and provide expert commentary.